If you die without life insurance, the only thing you may leave your family

... are school loans and debt

Being a new physician in a residency or fellowship program, or in the first few years of practice is an exciting time. And it seems that the only thing you think about is learning more about practicing medicine.

I get it. I was in that exact same situation many years ago. New in training/practice, with a spouse and two young children. A family that was totally dependent on my ability to generate an income.

Although I didn't think I had the time to worry about protecting my, and my family's financial future, I realized that it wasn't an option. It was something that I had to deal with. I only wish that at that time I had someone to work with that had my best interest in mind. A physician who lived through the same situation AND remembered what it was like.

Preparing and planning ahead of time is the only way you can protect yourself ... and your family, against the financial disaster that would happen if you died. Financial disaster you can manage and mitigate.

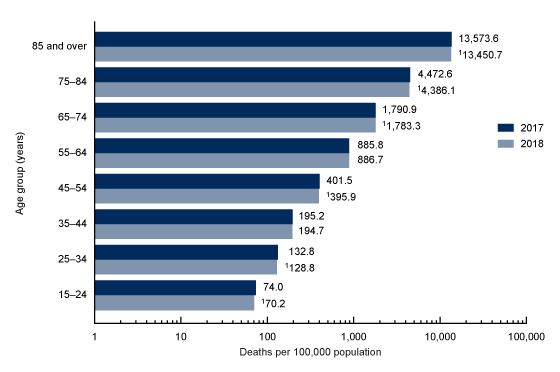

Each year 1.3 out of every 1000 individuals, age 25-34, will die (2017 statistics), yet at age 30, it is estimated that the average person has 50 more years to live. What will your family's future look like if your financial earning power is lost ... for their lifetime?

Physicians are not immune to these statistics.

*Some school loans (but not all) may have provisions to be forgiven upon the death of the borrower.

Why Get Life Insurance?

Nobody is invincible. In the event of your death, life insurance can provide a tax-free lump sum for your family to provide for living expenses. It can also help provide other financial benefits for your family such as eliminating your student debt, paying for your family's home and auto or funding your children's college education.

It can allow your family to continue with the lifestyle you worked so hard to obtain for them. It protects their future.

Properly planned life insurance can provide a financial and risk-reduction vehicle that can protect you now, and into the future, growing and changing with your life needs.

Life insurance and Disability insurance, together, can provide a solid program to protect your family's financial future through illness and death.

EVERY PHYSICIAN SHOULD PROTECT THE FINANCIAL FUTURE OF THEIR FAMILY IN CASE OF DEATH

Work with a reputable physician owned independent insurance brokerage that helps find the best and most cost effective insurance solution for your specific lifetime needs.

You have invested an enormous amount of time, effort and money to create your financial future. Without insurance protection, all of that investment can be lost ... in a moment ... due to death.

As A New Physician, Let's make a plan that fits you.

Maximum Coverage

Using term insurance, you can obtain the highest amount of death benefit for the lowest premium. As a new physician with lower income, but significant needs for your family and children, this is often your best option. This will serve you early on, but the right policy can grow with you.

Earlier IS better.

Lock In Optimal Ratings

Premiums are rated on many factors, including age. By locking in your risk rating at a younger age, you can benefit from that earlier action ... often resulting in lower premiums for the life of the policy, putting that money in your pocket. This can provide significant benefit to you for the life of your policy.

Grow With You

As you progress in your career, your life situation and income will change. With a convertible policy, you have the ability (but not requirement) to transform your original term policy into a financial vehicle that can be an important part of your financial planning.

Residents and Fellows In Training...

This is the BEST time for you to purchase your own policy.

Here's why....

- Best Rating can be locked in for the life of your policy

- Lock in future insure-ability when health issues such as heart disease, stroke, cancer or other medical issues result in future underwriting declines.

- Ability to increase future benefits

- Provide protection for your family's financial future

- Provide the ability to evolve your existing policy to achieve wealth accumulation and preservation strategies, when that time comes in your career.

Life Insurance .... Your Way, On Your Terms.

Working Together ... Through The Entire Journey

This is for physicians who would feel most comfortable working with a WhiteCoat representative ... from the start. Working together, from start to finish, can provide you with the answers and comfort level that you want, while examining options from multiple carriers.

Get Started On Your Own, And Have Us Review Your Plan

Are you a physician who likes to explore options and develop your own plan, but still would like an independent review it prior to finalizing it? This is a great option for you. Develop your own plan, then let's be sure your questions are answered and your best option selected.

Create Your Plan On Your Own ... From Start To Finish

Are you a physician who is comfortable and wants to develop your life insurance plan on your own? If so, this is for you. Plus, unlike other "online services" ... your WhiteCoat representative will be there to help, when you want it.

Do I REALLY need life insurance?

Who is life insurance for?

Why have a "personal" policy?

What factors impact your premiums?

What types of customization can I get for my policy?

How do I get more information?

Let Us Help Explore Your Options

Each person is unique and the coverage levels, options and premiums are different for each person. Let us provide quotes based on your specific information so you can make intelligent choices without guessing.

Quotes are free and without obligation.

As a PHYSICIAN OWNED AGENCY we understand the unique needs of practicing physicians. How? Because we have been in your exact situation, having practiced for over 35 years.

We provide you with options that are best for you ... not others.